SDIRAs tend to be utilized by palms-on buyers who will be prepared to take on the hazards and obligations of choosing and vetting their investments. Self directed IRA accounts will also be perfect for traders who definitely have specialized information in a niche market which they wish to put money into.

Opening an SDIRA can provide you with access to investments normally unavailable via a financial institution or brokerage company. Here’s how to start:

In contrast to shares and bonds, alternative assets are sometimes more difficult to provide or can include strict contracts and schedules.

IRAs held at banking companies and brokerage firms provide constrained investment options to their consumers mainly because they do not have the skills or infrastructure to administer alternative assets.

Bigger Fees: SDIRAs frequently include increased administrative expenditures when compared with other IRAs, as specific elements of the administrative procedure can not be automatic.

No, You can't spend money on your very own company that has a self-directed IRA. The IRS prohibits any transactions among your IRA plus your very own business enterprise since you, as being the owner, are deemed a disqualified man or woman.

Range of Investment Choices: Ensure the supplier permits the categories of alternative investments you’re enthusiastic about, for instance real estate, precious metals, or private fairness.

Quite a few buyers are amazed to discover that employing retirement cash to invest in alternative assets continues to be feasible because 1974. Nevertheless, most brokerage firms and banking companies deal with presenting publicly traded securities, like stocks and bonds, because they absence the infrastructure and knowledge to manage privately held assets, for instance property or non-public equity.

Larger investment selections implies you are able to diversify your portfolio outside of stocks, bonds, and mutual funds and hedge your portfolio in opposition to marketplace fluctuations and volatility.

The tax advantages are what make SDIRAs desirable For most. An SDIRA might be each common or Roth - the account sort you end up picking will depend mostly on the investment and tax method. Look at using your financial advisor or tax advisor in case you’re Doubtful that is finest for you.

Be in control of the way you improve your retirement portfolio by utilizing your specialized expertise and passions to invest in assets that match together with your values. Received experience in real estate or personal equity? Utilize it to help your retirement planning.

Building one of the most of tax-advantaged accounts helps you to maintain a lot more of the money that you just spend and gain. Depending on whether or not you select a traditional self-directed IRA or perhaps a self-directed Roth IRA, you've the possible for tax-totally free or tax-deferred growth, provided sure disorders are fulfilled.

Regardless of whether you’re a money advisor, investment issuer, or other economical Expert, investigate how SDIRAs may become a strong asset to expand your small business and reach your professional ambitions.

Consequently, they have a tendency not to promote self-directed IRAs, which supply the flexibility to take a position inside of a broader array of assets.

Entrust can help you in buying alternative investments with your retirement resources, and administer the obtaining and marketing of assets that are typically unavailable through financial institutions and brokerage firms.

Often, the charges associated with SDIRAs is often larger and more intricate than with a regular IRA. It's because from the enhanced complexity connected to administering the account.

Right before opening an SDIRA, it’s vital that you weigh the possible advantages and drawbacks according to your specific financial aims and chance tolerance.

In the event you’re seeking a ‘established and fail to remember’ investing strategy, an SDIRA possibly isn’t the right selection. As you are in total Manage in excess of every single investment created, It is really up to you to perform your individual homework. Remember, go to these guys SDIRA custodians aren't fiduciaries and cannot make recommendations about investments.

Moving funds from 1 kind of account to a different variety of account, for instance transferring money from the 401(k) to a conventional IRA.

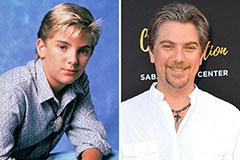

Jeremy Miller Then & Now!

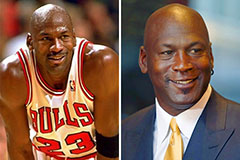

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!